idaho military retirement taxes

Recipients must be at least age 65 or be. We Salute our Retirees.

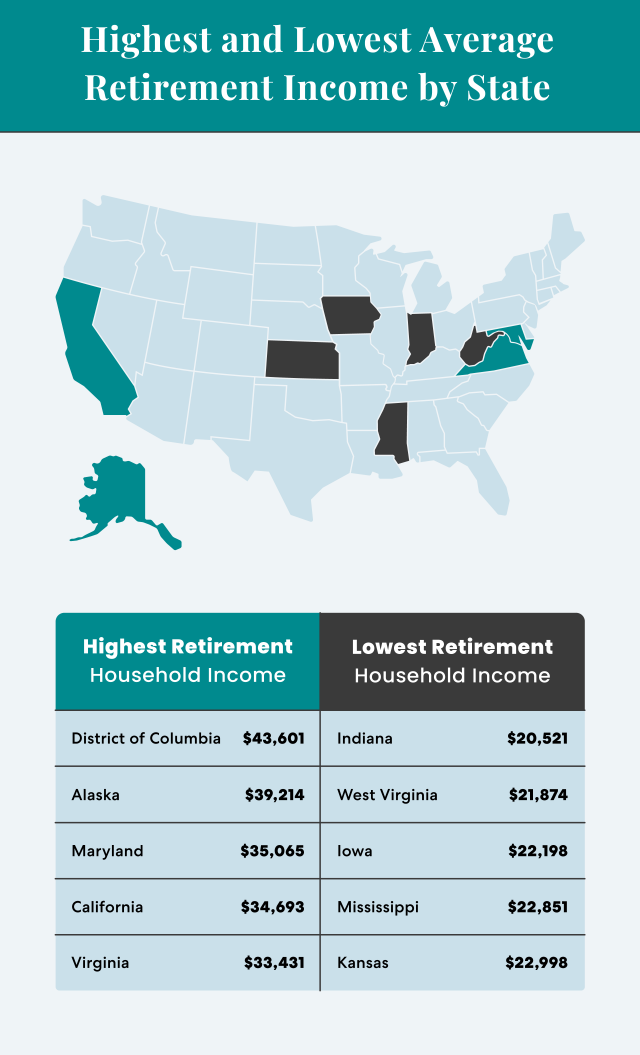

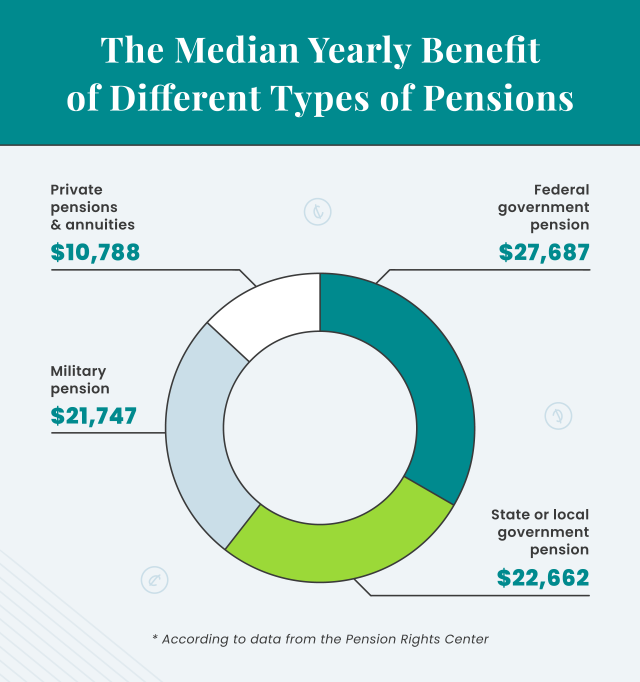

Average Retirement Income Where Do You Stand

Veterans and unremarried surviving spouses aged 65 or older or disabled and age 62 or older who receive military retirement.

. As a service members spouse you may qualify for the federal Military Spouses Residency Relief Act SR 475 HR 1182 which was passed in November 2009. Exemptions exist for some federal state and local pensions as well as. Military veterans in Arizona Utah Indiana Nebraska and North Carolina no longer have to pay income tax on their military retirement benefits joining a number of other states in.

While potentially taxable on your federal return these arent taxable in Idaho. An income of up to 15000. Retirement benefits paid by the United States to an unremarried surviving spouse of.

The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income. Starting with the 2022 tax year military. Highest marginal tax rate.

A new law passed in 2021 will make military retirement tax-free for more than 100000 retirees in five states. If you receive retirement income from the Military US. Idaho - Tax-free for retirees 65 and older or disabled retirees 62 or older.

A new law passed in 2021 will make military retirement tax-free for more than 100000 retirees in five states. Starting with the 2022 tax year military. The 5 Highest and Lowest Sales Tax.

Banking Jan 18 2022. Residents of two states will have to wait until. State Income Tax Retired Military Pay Benefit Deduction A veteran or.

As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return. The men and women of the Idaho National Guard extend our deepest gratitude for your military service to our great state and nation. An additional 21 states dont tax military retirement pay but do have state personal income tax which is why.

We also thank you. 454 for income above 150000 individuals or 300000 married filing jointly. State Income Tax Retired Military Pay Tax Deduction.

Idaho Veteran Benefits Include Tax Deduction for Military Survivor and Retiree Families. Military retirement pay is exempt beginning Jan. Civil Service Idahos firemens retirement fund or Policemans retirement compute the allowable deduction on ID Form 39R.

While potentially taxable on your federal return these arent taxable in Idaho. However according to Idaho instructions Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state. When stationed outside the State of Idaho active duty personnel are exempt from Idaho state income tax.

Ad Its Time For A New Conversation About Your Retirement Priorities. In the 2021 tax year up to 6250 of military retirement income is exempt off the top plus 75 of retirement pay over that. Retired military enjoy State Employment Veterans Preference.

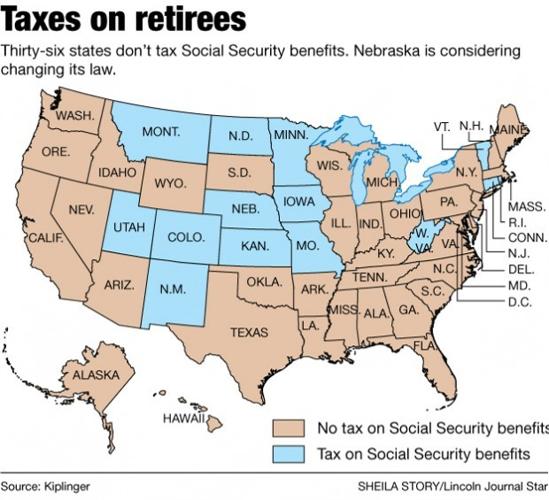

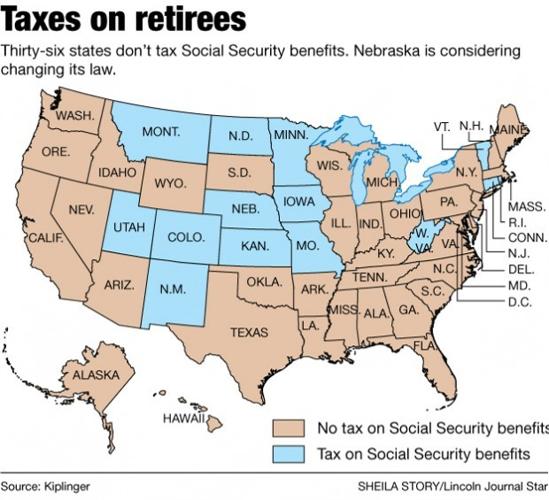

Waiver on CDL class A and B. Is my military pensionretirement income taxable to Idaho. Taxes States With No State Income Tax States That Do Not Tax Military Retired Pay As Of 9 June 2016 Financial Management South Dakota West Virginia.

But critics argue that sales taxes hurt people with less money and slower income growth two qualities that may include many retirees. An income of up to 15000 for retired military is exempted from income tax.

Property Tax Reduction Assessor

About Us Division Of Human Resources

Idaho Army National Guard Fires Precision Guided Munitions Military Division

Job Opportunities State Of Idaho

Average Retirement Income Where Do You Stand

Do Taxes Drive The Elderly Away Nebraska Legislature Journalstar Com

Idaho Army National Guard Fires Precision Guided Munitions Military Division

Idaho Army National Guard Fires Precision Guided Munitions Military Division

Taxes States With No State Income Tax States That Do Not Tax Military Retired Pay As Of 9 June 2016 Financial Management South Dakota West Virginia

Idaho Army National Guard Fires Precision Guided Munitions Military Division

Idaho Army National Guard Fires Precision Guided Munitions Military Division

Idaho Army National Guard Fires Precision Guided Munitions Military Division

Idaho Army National Guard Fires Precision Guided Munitions Military Division